Running a subscription business is unlike running any other type of business and doing so successfully requires knowledge and focus of the metrics that matter. Knowing and consistently monitoring these important metrics is crucial to understanding the past and making informed decisions about the future. However, tracking too many metrics can lead to analysis paralysis, not to mention the significant costs associated with the preparation and upkeep of the metric data sets. In this article, we will explore the five most important metrics to track, how to calculate them, and why each is vitally important. By understanding and acting on these metrics, you can make data-driven decisions that will help your business thrive.

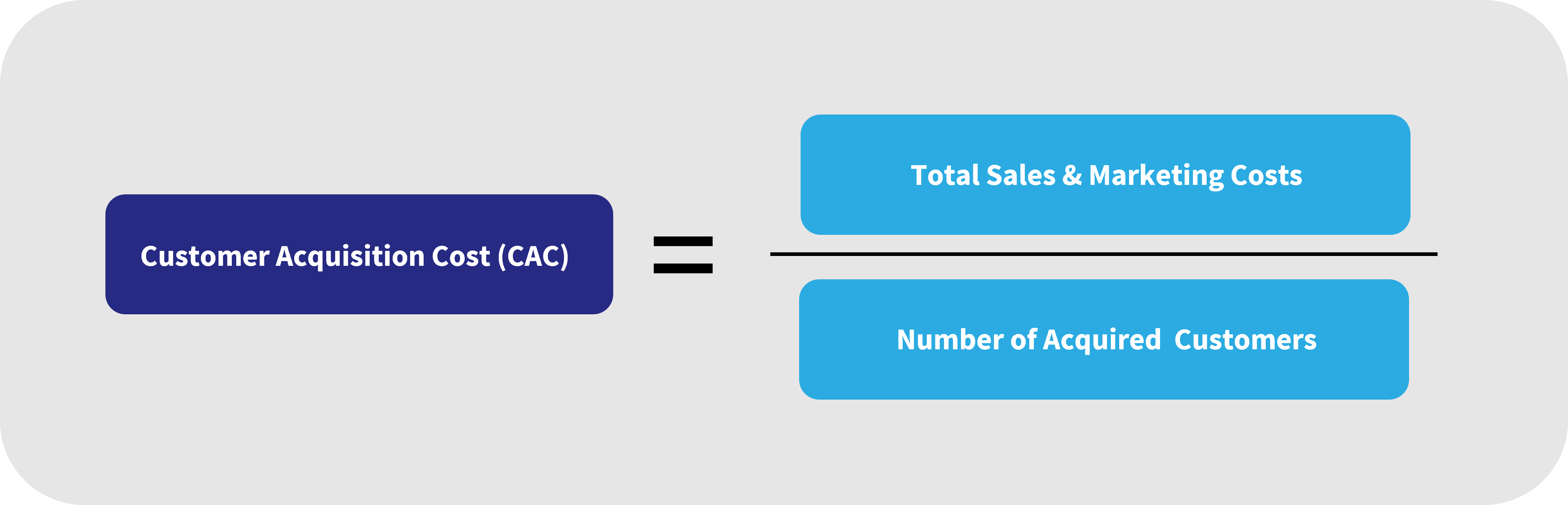

Customer Acquisition Cost (CAC)

What does it mean and why is it important?

CAC illustrates the average spend required to acquire a new customer. This metric provides you visibility into the approximate capital required to grow your business to the desired levels. A lower cost indicates good brand awareness and a strong acquisition funnel, while higher costs may highlight product or platform problems needing attention.

Considerations

- Calculating CAC over a short period of time can be misleading since costs such as marketing and ad spend often carry long lead times relative to resulting revenue. It’s best to measure over a minimum of 6 months or more.

- If a trial period is offered, be sure to include the product and servicing costs of this trial within your marketing costs. Trials are a part of the customer’s purchasing decision in those cases.

- Be sure to include all sales expenses, including salaries, tools, software, and prospect list purchases that your organization would not have otherwise incurred in customer servicing.

- There are several key factors that can impact CAC. These factors include: marketing and sales expenses, lead generation and conversion, product or service pricing, sales cycle, channel mix, target customer, seasonality, and market competitiveness.

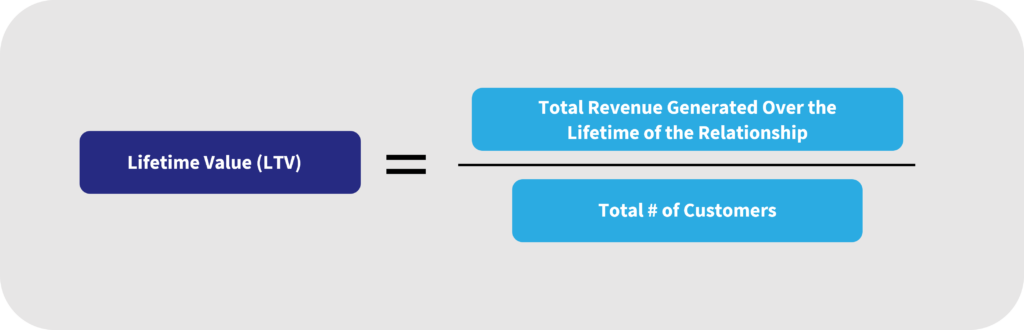

Lifetime Value (LTV)

What does it mean and why is it important?

Simply put, lifetime value is the total amount of revenue expected over the lifetime of a customer relationship. As stated, this metric uses ‘total lifetime’ revenue. Therefore, in the infancy of a business or in a scenario that introduces a large number of newer customers, LTV will be a more dynamic calculation. Increasing LTV numbers indicate happy customers that are staying longer and/or buying higher priced products. Conversely, LTV that is trending downward could be caused by dissatisfaction with the customer experience, resulting in reduced customer loyalty, an inability to cross-sell or upsell, or other factors leading to increased churn or a reduction in revenue collected per user.

Considerations

- Calculating LTV for startups is difficult since knowing how long customers will remain is not yet fully known. In these situations, an educated guess for LTV can be used in the CAC:LTV ratio

- Segmenting customers by demographics, purchasing behavior, acquisition channel and other factors can help you understand which segments are the most valuable. Focusing on the most valuable segments can lead to higher LTV.

- Focusing on providing great customer service and investing in retention efforts can increase customer loyalty as well as lead to upsell and cross-sell opportunities.

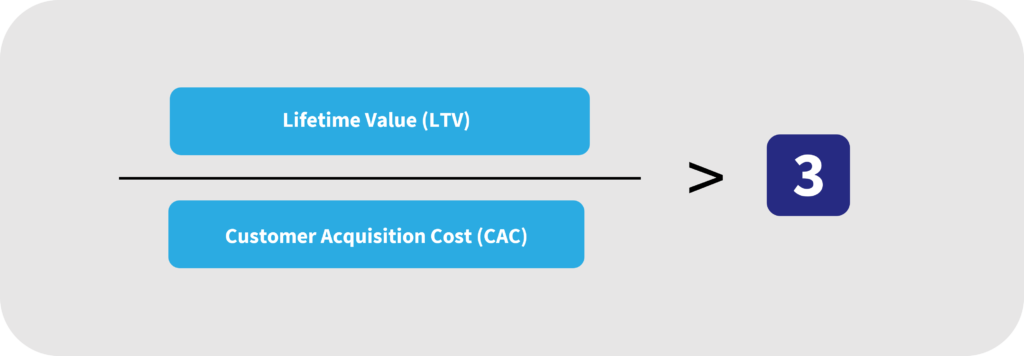

The CAC to LTV Ratio

The ratio represented as the lifetime value of a customer divided by the cost to acquire a customer is perhaps the single most important measurement. It simply compares the cost of acquiring a new customer (CAC) to the lifetime value of a customer (LTV) to help you understand the ratio of funds your organization is spending on acquiring new customers compared to the amount made from them in the long run. A lower ratio means that you are making more money from the customer over their lifetime than it costs to acquire them, while a higher ratio means the opposite.

Considerations:

- A ratio of at least 3:1 is considered “good”. However, if the ratio is nearing 1:1 or CAC exceeds LTV, this is indicative of a big problem with funds to acquire customers far outpacing the lifetime value of a customer

- Focus on reducing CAC by improving marketing and sales efforts, while also increasing LTV by improving customer retention, upselling and cross-selling opportunities. Additionally, focus on acquiring customers from segments that have a higher LTV.

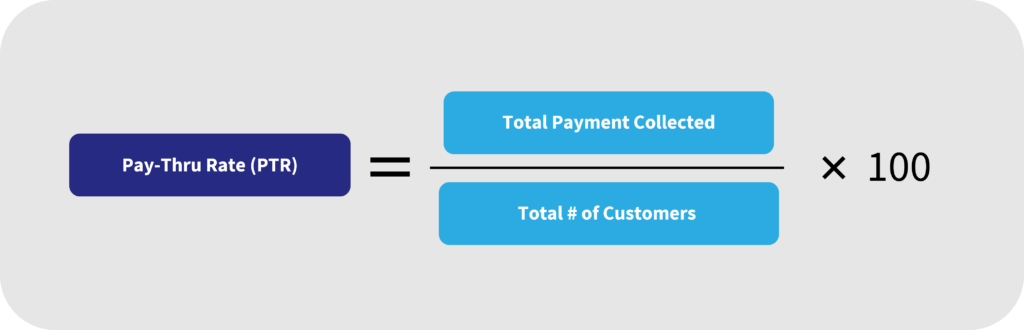

Pay-Thru Rate

What does it mean and why is it important?

Pay-Thru Rate, also known as Collection Rate, Payment Rate or Bill-Thru Rate, measures the ability to collect payment from each customer that was billed. This rate will vary based on a variety of factors including payment method, payment amount, product, merchant ID (MID), and may also be impacted by broader economic factors.

Pay-thru rates above 90% are generally considered satisfactory but can vary dramatically for the reasons mentioned above. Consistent measurement and analysis of trends within your organization’s subscription portfolio is the most valuable.

Considerations

- Not all pay-thru rates are calculated identically. Ideally, this is a measurement of all payment attempts to collect billed invoices.

- Do not confuse pay-thru rate with authorization rate. While related, authorization rates are reflective of all collection attempts, whereas pay-thru rates reflect the net result of all attempts. For that reason, authorization rates are lower than pay-thru rates.

- Separate initial and renewal terms when analyzing pay-thru rates. Initial terms, or the customer’s first period, behave differently since these are usually customer-initiated transactions (CIT). Renewal transactions, where the merchant initiates and the customer is not directly involved, collect at a lower rate and are impacted by your transaction recycling and dunning strategies.

- The initial pay-thru rate for customers coming out of a free trial or introductory price periods should be considered in your segmentation and analysis. Generally, pay-thru rates are low for the first payment after these periods. Focus on the customer experience, onboarding, and delivering value during free trial and introductory price periods to increase the initial pay-thru rate.

Churn

What does it mean and why is it important?

Losing customers is a painful reality for any subscription business. While retention efforts should be in place, businesses must accept that some customers will leave for reasons beyond the business’s control. Beyond the regulatory requirements for making it easy for customers to cancel their subscriptions, we’ve discovered that handling cancellation requests in a courteous and professional manner leaves a positive impression on the customer and increases the likelihood of winning them back in the future.

Tracking churn over time is essential for both revenue forecasting and identifying operational issues that may be causing customers to cancel their service. By monitoring churn, businesses can predict future revenue, identify and address issues related to customer service, product or service quality, and allocate resources effectively to better retain customers. Additionally, it helps to identify at-risk customers and prioritize customer segments that are more likely to churn, it also allows for benchmarking against industry standards. An increasing churn rate is often linked to a poor Net Promoter Score (NPS), which illustrates that customers are unhappy with the product or service.

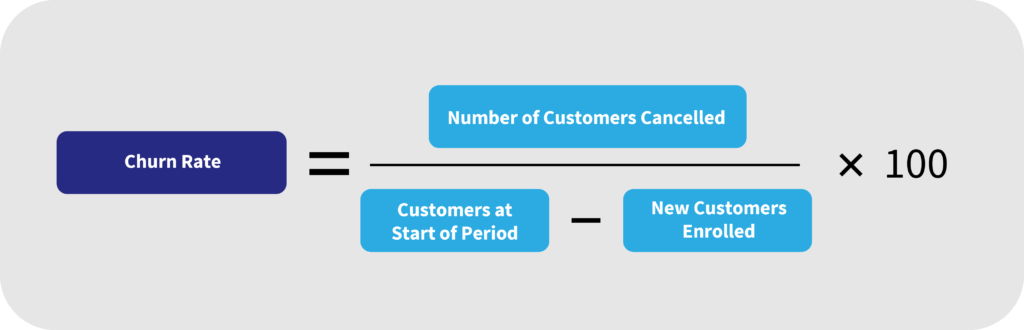

Calculating churn is performed by taking the number of customers who canceled in the period divided by the total number of customers at the start of a period, less any new enrollments during that period.

Considerations

- Not all types of churn are equal and, like pay-thru rates, should be evaluated separately. Involuntary churn, or when a customer is canceled due to billing issues or other technical reasons, requires a different type of attention than churn caused by customers who cancel voluntarily.

- Stay current and in compliance with automatic renewal and cancellation laws and regulations. Although doing so may not result in an immediate improvement in retention, it can build the trust your customers have with your brand.

While there are myriad metrics that you can track when monitoring the health of your subscription business, the five metrics Rebar recommends that subscription businesses quickly get a handle on are the metrics discussed above. Having the right subscription billing system and support in place can help optimize these metrics. Rebar’s team of subscription billing experts works with companies of all sizes, providing insights and guidance to help make subscription billing easier and increase your bottom line. Contact us to start talking to one of our subscription payment experts.