Customer payments need to be easy, which means providing numerous payment options such as different credit cards, debit cards, bank transfers and more. But, often, making payments easier for customers means making things more complicated and costly for your business. Without an in-depth understanding of your Cost of Acceptance—which includes credit card processing fees and a host of other, lesser-known fees—you have no way of maximizing your company’s profitability.

The Cost of Acceptance, Defined

Typically represented as a percentile, the Cost of Acceptance refers to all the fees associated with payment processing and acceptance. Many merchants aren’t aware of all their Costs of Acceptance or how to calculate them—nor are they aware of how to lower that cost.

The Cost of Acceptance can include all the following and more:

- Processing fees

- Interchange fees

- Assessment fees

- Reporting fees

- Support fees

- Service fees

- Chargebacks

- Security and PCI fees

The Confusing World of Credit Card Processing Fees

On the surface, credit card processing fees may appear to be straightforward. A customer pays with a credit card, and the business pays a small percentage of that cost to its processor. That fee typically ranges anywhere from 2% to 5% for each transaction. For most merchants, it’s a sunk cost and one that they accept without question.

But should they?

There is not a “typical” credit card fee—in fact, the fees are surprisingly wide-ranging. Some merchants pay a relatively straightforward fee commonly referred to as “blended pricing.” With blended pricing, the merchant pays the same fee rate for every transaction. There is also interchange plus pricing, in which a merchant is charged the direct network and interchange fees plus a per transaction fee to their processor. Note that there is no “correct” way to do this—some strategies will benefit some merchants more than others and a given merchant’s best pricing strategy may even change over time as their volume grows.

Generally, however, the more transactions you process, the less per-transaction percentage you will pay, which is why larger companies usually pay less per transaction than small-to-midsize merchants. But what are those volumes? Why do some cards charge higher rates than others? Why don’t all banks charge the same fees? Why are you being charged random one-off fees and support fees? Are you paying fees for encryption and tokenization? Are you charged fair exchange rates for international currency? No matter what you think you’re paying, chances are, after you’ve added in many of these hidden costs, the real cost of accepting credit cards is higher than you believed.

When determining your Cost of Acceptance, you need to consider a large number of factors, including the following:

- Card brand

- Card type (credit, debit, loyalty, membership, etc.)

- Routing path

- Transaction volume

- Country of origin

- Average ticket size

How Much Can You Save?

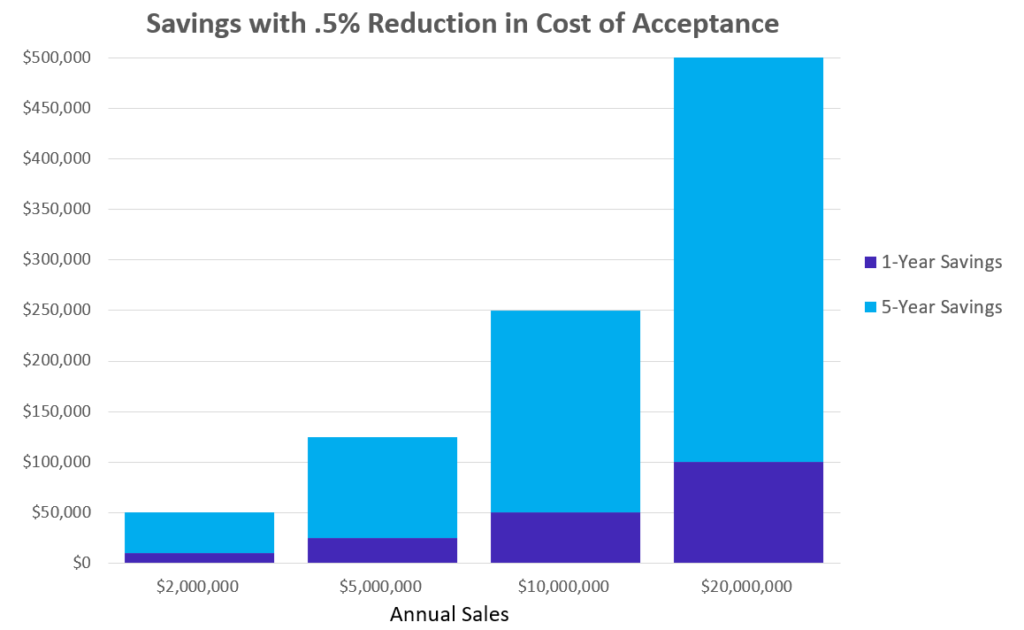

We recently performed a Cost of Acceptance Analysis on a business doing $200K per month in subscription services. It identified some simple changes that saved them 0.5% on their total cost of acceptance, equating to $12,000 a year, or $60,000 in savings over five years.

The Value of a Cost of Acceptance Analysis

As a merchant, if you fail to compute your Cost of Acceptance, you could leave a great deal of money on the table. Due to the complexity of credit card processing fees, among many other costs, finding an accurate Cost of Acceptance is frustratingly complicated. To do so, you need to do all of the below and more.

- Collect all monthly bills and payment vendor contracts

- Consolidate data on payment costs

- Analyze total payments costs

- Compare costs to sales to determine the percentage of revenue

- Do an industry/competitor analysis

- Assess ways to lower payment costs

Get a Free Cost of Acceptance Analysis

Instead of performing your own Cost of Acceptance Analysis, you’ll probably want to hire an outside company to do it. Unfortunately, such an analysis can cost thousands of dollars.

Until now.

Rebar Technology is offering a free Cost of Acceptance Analysis for a limited time. We’ll look closely at your processing fees to determine how they impact your bottom line. We have decades of to analyze payment costs and benchmark them against industry competition.

To get started, sign up here. One of the Rebar Technology consultants will be in touch soon.