Let’s face it, the payments industry can be confusing. With its jargon, acronyms and multiple layers, how can you know if your current setup is ideal?

One common question that we often hear is, “What is the difference between a payment processor and a payment facilitator, and which is the best solution for me?” The differences are important distinctions that depend on a few factors. Making the right choice is critical because the wrong approach can be costly.

To understand these differences, it’s helpful to start with a general overview. At the highest level, credit card payments in the U.S. are dominated by four major brands that everyone has heard of: Visa, Mastercard, American Express and Discover. These firms manage networks that allow credit card transactions to process. They, and the card issuing banks, set interchange fees—basically the toll for accepting a credit card payment—which gets passed down through the chain to the merchant. That’s the discount fee that a merchant will pay on a credit card transaction, but it’s not a one-fee-fits-all formula. The cost varies based on the card type, business type, card acceptance method and other factors.

The next players are the acquirers or acquiring banks. These companies facilitate the ability of the merchant to take credit card payments. Think of them as managing the entrance and exit ramps of the tollway. They have direct connections into Visa, Mastercard and others, and feed the transaction data into their networks. Don’t confuse this function with that of the issuing banks or credit card issuers. Acquiring banks route the charge through the network and fund the merchant. Issuing banks provide cards to consumers. In many cases they are the same companies, but the functions are different.

Lastly, those that accept cards for payments are the merchants. These are every type of business, whether it is selling digital or physical goods or services. The relationship between the acquiring banks and the merchants is where things get interesting, and it’s where the question of payment facilitators vs. payment processors comes in.

What is a Payment Facilitator (Payfac)?

Payfacs are an evolution of a long-established distribution model in the payments industry. Here, ISOs (Independent Sales Organizations if on the Visa network), or MSPs (Member Service Providers if Mastercard) sell credit card processing services to merchants on behalf of an acquiring bank. This means providing equipment, services and support to the merchants, and helping them apply for and qualify for a merchant account. For ISOs/MSPs, the sometimes-arduous process of getting merchant account approvals for smaller businesses means they must charge higher fees to be profitable.

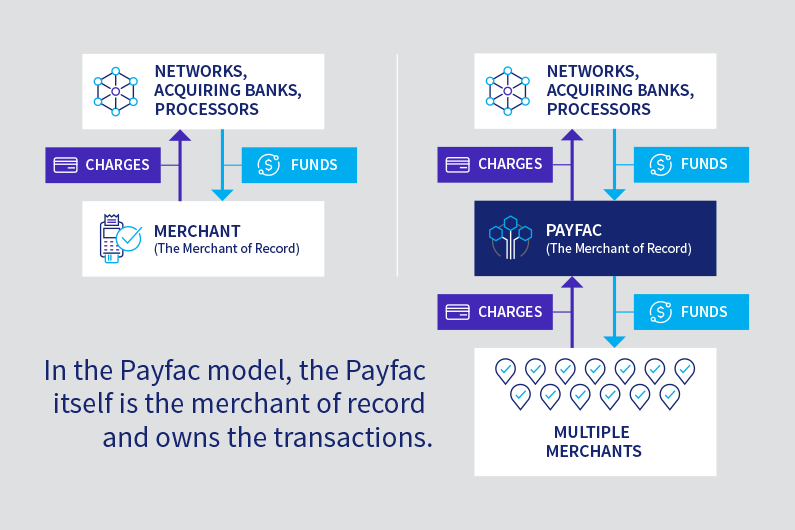

This challenge drove the more recent creation of payment facilitators. Here, the Payfacs are themselves the merchants of record. Rather then setting up each of their clients with their own merchant account, the Payfac lets them piggyback on the Payfac’s account. This also means the Payfac assumes the merchant’s credit liability, but they diversify this risk by aggregating a large pool of merchants under them. This approach allows Payfacs to sign up merchants quickly, since they don’t rely on an acquiring bank’s underwriting team to evaluate each merchant.

While convenient, there are some drawbacks to this approach. For the merchant, there is some loss of control and limited customization—such as billing statement descriptors which may not clearly list the merchant’s name and can be confusing to consumers. In addition, the fee paid to a Payfac is usually higher than with a direct merchant account. For small businesses, the pros likely outweigh the cons. But for companies collecting more than $1 million per year in revenue, the higher costs might not be worth the added convenience.

What is a Payment Processor?

A payment processor technically refers to the technology that processes the merchant’s transactions for the acquiring bank/acquirer. Confusingly, it’s a term that’s often used interchangeably with acquirer, because sometimes this function is performed by the acquirer itself (although it is also sometimes performed by an independent third party). In short, working with a payment processor means a direct connection to the acquiring bank, whereas a Payfac is a different entity altogether which “owns” each transaction.

Connecting directly to a payment processor will typically reduce transaction fees. In this case, rather than pay the Payfac’s blended fee, a business at scale should qualify for interchange plus. This is the base interchange fee plus a separate per-transaction fee that can be negotiated, especially for merchants with a higher volume of transactions. The merchant also has the flexibility to shop their acquiring bank/payment processor for better pricing. This can be significant. For a company at $100M in revenue, every 0.1% in fees represents $100,000 annually.

This freedom also allows merchants to work with more than one payment processor—using one for debit card transactions, for example, and a different one for credit. In this way, they can find and secure the best possible rates for every transaction.

Payfac or Payment Processor—Which is Right for You?

A decent rule of thumb is that if your business does less than $1M per year in revenue, the convenience and simplicity of a payment facilitator may make sense. For larger businesses, however, working directly with a payment processor/acquiring bank is likely best. Your choice will impact many aspects of your payments structure, including your subscription payments software—as some off-the-shelf solutions may limit your freedom to pick and choose what works best for you. Rebar, with our modular system, is one notable exception, as our subscription payments technology brings together the best of off-the-shelf and custom-built solutions.

Making the right payment decisions will help you maximize profitability, accelerate cash, enhance the customer experience and optimize your internal operations. If you need to know more or need help creating a complementary and smart payments subscription software solution, call us and schedule a consultation.