Introduction

Whether you are part of an emerging fintech start-up, a seasoned e-commerce platform, or a large multinational organization, understanding payment tokenization is fundamental to secure, efficient, and compliant digital transactions.

This white paper is the first in a two-part series that guides organizations through the complex landscape of payment tokenization. The series consists of:

The Art of Payment Tokenization: Strategies, Options and Considerations – An exploration of payment tokenization, examining various options and strategies. (Current paper)

The Art of Payment Token Migration: From Planning to Execution – A detailed guide covering the process of token migration, including planning, execution, challenges, and how to overcome them.

By engaging with this series, you will gain a comprehensive understanding of payment tokenization, from foundational principles to the practical steps needed for migration. Whether new to the field or looking to refine existing practices, the insights offered across these papers will provide valuable guidance.

In this paper we will explore the concept of payment tokenization, its importance, various options and strategies, and considerations for choosing what is best for you and your organization.

What is Payment Tokenization?

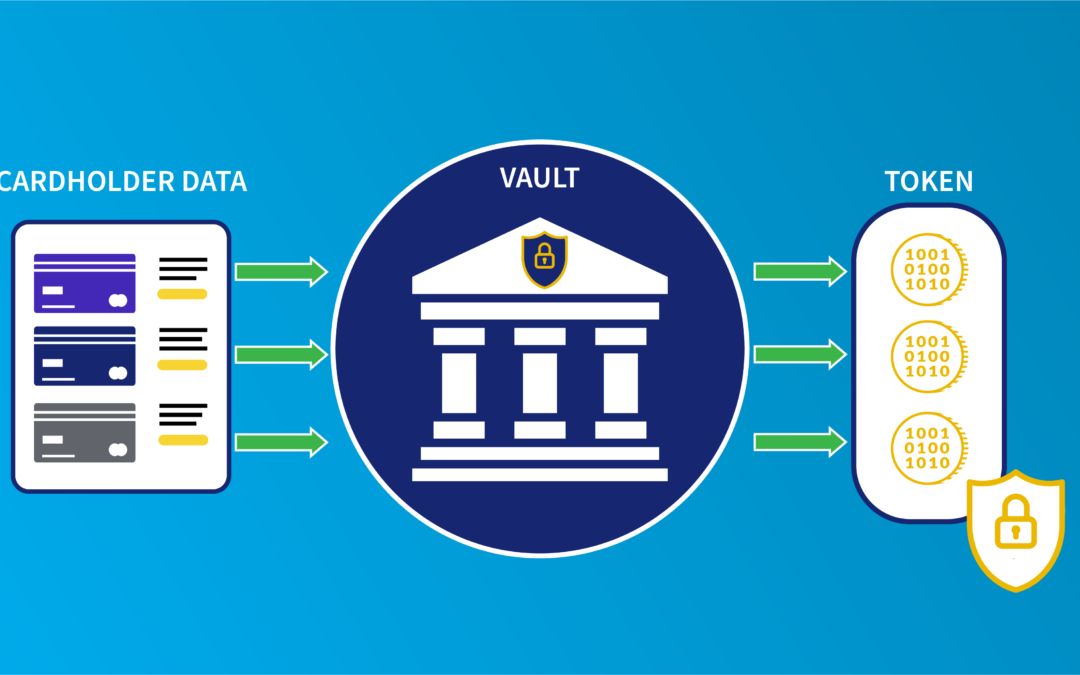

Payment tokenization is a process that replaces sensitive cardholder data, such as the primary account number (PAN), with a unique, randomly generated substitute known as a token. This token has no meaningful value if breached and can only be decrypted by a token vault residing in a secure environment.

The primary purpose of tokenization is to secure cardholder data, reducing the risks associated with data breaches and fraud. Tokenization is particularly important for businesses that process card-not-present transactions, including e-commerce and recurring billing merchants.

Furthermore, tokenization enables a more seamless customer experience by facilitating features like one-click checkouts, auto-fill payment details, and recurring payments. It also helps businesses reduce the scope of their Payment Card Industry Data Security Standard (PCI DSS) compliance by removing sensitive data from systems that do not require it.

Understanding Tokens

Tokens are unique, randomly generated substitutes for sensitive data. In the context of payment processing, tokens replace cardholder data, such as the PAN, with an alternative identifier. This token can be used for subsequent transactions without exposing the sensitive cardholder data it represents.

There are several types of tokens, including payment tokens and security tokens. Payment tokens are used in payment processing to protect sensitive cardholder data. Security tokens, on the other hand, are used in various areas of cybersecurity to secure access to resources.

Tokens can be either single-use or multi-use, depending on the tokenization method and business requirements. Single-use tokens are used for one-time transactions and discarded afterward, while multi-use tokens can be used for recurring transactions or stored for future use.

Having explored the fundamentals of tokens, it is crucial to delve into why tokenization itself is essential, considering its multifaceted impact.

Why is tokenization essential?

Tokenization plays a pivotal role in ensuring security, compliance, enhancing customer experience, and improving payment success rates:

- Security: By replacing sensitive cardholder data with tokens, tokenization helps prevent unauthorized access and use of card data, thereby protecting against data breaches and fraud.

- Compliance: Tokenization reduces the scope of PCI DSS compliance by limiting the systems that store, process, or transmit cardholder data. This simplifies compliance and mitigates the associated risks and penalties of non-compliance.

- Enhanced Customer Experience: With tokenization, customers can enjoy seamless, frictionless payment experiences. It allows for convenient features like one-click checkouts and recurring payments, which help build customer trust and loyalty.

- Improved Payment Success Rates: Network tokenization, in particular, can improve payment authorization success rates. Network tokens can be automatically updated when a customer’s card information changes, reducing the chance of declined transactions due to outdated card details. This increases payment success rates and creates a smoother experience for customers.

Examining Strategies for Payment Tokens

When it comes to payment tokenization, your chosen strategy can significantly influence the complexity of your solution. Each strategy has unique benefits and challenges, and understanding these can guide you toward an informed decision that aligns with your business’s needs, capabilities, and resources. Here is a detailed look into each approach:

- Home-Grown/Merchant Tokens: Implementing your in-house system for tokenizing payment card data allows you to maintain maximum control over your data, its usage, and security. This strategy offers flexibility, as you can tailor the system to your specific needs. However, it demands considerable time, resources, expertise, ongoing management, updates, and PCI compliance. Risks include potential data breaches and increased liability.

- Network Tokens: Using tokenization capabilities of card networks, like Visa, Mastercard, American Express, Discover, etc. can enhance security, reduce risk and fraud, expand acceptance, and reduce costs. Network tokens can also improve authorization rates by keeping up with changes in card details. This approach, however, may limit flexibility, as you are bound to the rules and systems of the card networks. Also, not all card types or regions may be supported.

- Gateway/Acquirer Tokens: Opting for tokenization through your payment gateway or acquirer can simplify the process and provide continuous support. Some gateways and acquirers also support network tokenization, giving you access to its benefits without requiring direct integration with the card networks. These entities usually have established systems and protocols, expediting, and streamlining token management, reducing risks, and ensuring seamless integration with your payment processing setup. However, this method might entail higher costs, and your operation depends on their systems.

- Token Service Providers: Engaging specialized third-party providers for tokenization can save time and internal resources. These providers bring expertise in securely handling and managing tokens, potentially offering advanced features beyond what is achievable in-house, including support for network tokenization. While this approach can be costly, the added value might justify the investment.

- Hybrid: A hybrid strategy involves a combination of the above methods, tailored to your specific needs. This could mean managing some elements of tokenization in-house while outsourcing others. This approach offers flexibility and control but demands careful management to ensure seamless and secure operation.

Each tokenization method requires careful consideration of your unique context, including your current payment environment, technical capabilities, budget, timeline, and strategic goals. These choices can significantly impact the complexity and effectiveness of your tokenization solution.

Handling tokenization in-house gives you full control, but it may increase the complexity. Conversely, choosing a gateway/acquirer or a third-party provider may simplify the process but might incur higher costs and necessitate a strong reliance on your gateway/acquirer.

A hybrid approach can offer the flexibility of managing some aspects internally while outsourcing others. However, this could lead to coordination challenges requiring a clear delineation of responsibilities and thorough testing.

There’s no one-size-fits-all approach to payment tokenization. The best strategy depends on your specific needs, capabilities, and business objectives. Your goal should be a secure, efficient, and compliant tokenization setup that supports your business’s growth and adapts to the evolving payment landscapes.

Now, let us move on to the critical process of formulating your specific tokenization strategy, a blueprint that aligns with your organization and serves as the foundation for your tokenization journey.

Formulating Your Tokenization Strategy

Your tokenization strategy serves as the blueprint for your tokenization journey. Therefore, it is essential to carefully consider the numerous factors that can influence this strategy.

- Business Size and Industry: Larger organizations or those operating in highly regulated industries may need more robust tokenization solutions and may lean towards an in-house or hybrid model. On the other hand, smaller businesses or startups may find third-party solutions more manageable and cost-effective.

- Resources: Do you have the IT staff and budget to develop and maintain an in-house tokenization solution? If not, a third-party provider might be the way to go.

- Budget: Consider both the upfront costs and ongoing expenses of maintaining your tokenization solution. While in-house solutions might require a more substantial initial investment, they may offer more significant cost savings in the long term.

- Future Needs and Scalability: Anticipate your future business needs and how they might evolve. Does your chosen tokenization option offer the flexibility and scalability to grow with your business?

Once you have carefully considered these factors and chosen your tokenization strategy, you will be well on your way to initiating your tokenization journey. It is time now to think about the road to migration and prepare for the next steps.

Conclusion

Payment tokenization offers myriad benefits for organizations of all sizes and across all industries, from enhancing security and compliance, improving authorization rates, and enhancing customer experience. As you explore your tokenization options and formulate your strategy, you must consider your organization’s unique needs and goals. With careful planning, you can navigate your tokenization journey successfully.

As we turn our gaze towards the next critical phase, we at Rebar Technology invite you to join us for our upcoming whitepaper, ‘The Art of Payment Token Migration: From Planning to Execution.’ This installment will guide you through the multifaceted journey of token migration, providing a comprehensive step-by-step guide to planning and execution. Dive into the complexities of navigating the stored credential framework, understand the post-migration impact through monitoring, and discover strategies to overcome common challenges. Stay tuned as we demystify the art of payment token migration, equipping you with the insights and methodologies needed to undertake this vital transition.

Let us continue to unlock the potential of payment tokenization together! For further discussion on how to approach your tokenization strategy, please reach out to us at [email protected]. Whether you are just starting out on your tokenization journey or getting ready for a migration, we are here to help.